Melio Payments Review

You’ve definitely heard of Melio Payments, if you’re one of those people who constantly scan the market to see what new goods and services will aid proprietors of small businesses in thriving in good times and surviving in bad. We’ll delve into its features and what it can do for users in this post.

We have used this tool for 3 months for making payments and writing indepth Melio Payments review.

What Is Melio Payments?

For US small businesses across all industries, Melio Payments is a free Accounts Payable software that reduces busywork and increases cash flow. With Melio, consumers may quickly pay bills online with a debit card, credit card, or bank transfer.

Small businesses can create and manage accounts on Melio for free. Accountants, freelancers, small businesses, and medium-sized businesses are typical Melio users.

Melio enables users to connect with their accounting software and arrange payment transactions automatically. It also supports QuickBooks synchronization. Small enterprises are meant to use Melio.

A $110 million new round of funding was also recently granted to Melio. With this additional cash, they have now received $254 million in total. This funding will give the business the ammunition it needs to keep adding more services to add value and help any small business owner with the process of paying their bills, accepting payments from other vendors, and making sure the accounting details surrounding all these transactions are properly documented.

By enabling small businesses to pay their vendors through ACH bank transfer, credit card, or debit card, even if the vendor they are paying only accepts checks, Melio makes paying vendors simple and hassle-free. It’s simple to pay merchants with Melio.

You can pay suppliers, contractors, and vendors more easily by using free bank transfers or credit/debit cards even if they only accept checks, so there are no recurring charges or subscription fees. You no longer need to write checks because Melio automatically syncs with your QuickBooks and mails checks to vendors on your behalf.

What Does It Do?

As mentioned above, users of Melio can pay suppliers by bank transfer for nothing, even if they only take checks. Users can pay with a credit card, however, there is a 2.9% transaction fee.

The process of using Melio consists of just three simple steps. First, users must add information about vendors or bills. The user can input information manually, add files, or photograph an invoice using Melio. After that, users are able to pay with a credit card or through a bank transfer. It is possible for users of scheduling software to plan their payments at any time they choose. After depositing the check, Melio sends it to the vendor by mail or personally goes to their bank.

With Melio, users can manage payments whenever they want, from any location, using any internet-capable device, including PCs, laptops, tablets, and smartphones.

By simply logging into the customer dashboard and entering the invoice details, Melio’s platform may pay any vendor bill. These are just a few of the bills that Melio Payments can be used to pay.

- Business Services

- Contractors & Freelancers

- General Business Expenses

- Insurance Bill

- Legal Services Bill

- Marketing & Ads

- Rent/Lease Bill

- Tax Bill

- Utility Bill

Main Features of Melio Payments:

Any small business can benefit from Melio’s comprehensive feature set to manage cash flow and facilitate the accounting process, which includes Quickbooks integration.

The tools come with your account for free and greatly aid in managing your payment and accounting flow. They consist of the following:

- Invoice Management

- Capture

- Customizable Invoices

- Deferred Billing

- Due Date Tracking

- Invoice Processing

- 1099 Preparation

- Matching

- Payments

- Workflows

- Check Processing

- Check Writing

- Accounts Payable

- Accounts Receivable

- Analytics

- Due Dates

- Payment Tracking

- Billing & Invoicing

- Cash Management

- Duplicate Payment Alert

- Integration

- Accounting

- Payment Integration

- Fraud Detection

- Invoice Processing

- Bookkeeping Services Integration

- PCI Compliance

- Payment Processing

- Encryption

- Credit Card Processing

- Electronic Funds Transfer

- Expense Tracking

- Recurring Invoicing

- Vendor Management

- Administration

- Processing Fees

- Omnichannel

- Levels 1 & 2

- Client Management

- Contact Database

- ACH Payment Processing

- Approval Process Control

- Approval Workflow

- Bank Account Reconciliation

- Payment Options

- Mobile Payments

- Online Payments

- Partial Payments

- Recurring Payments

- Recurring/Subscription Billing

- Multiple Payment Options

- Online Invoicing

- Payment Processing

- Platform

- Self Service Portal

- Accounting integration

As you can see, the team behind Melio did all possible to create a platform that any small business can use to manage accounts payable in addition to providing a wide range of other services, and rest assured that they are still working on it.

Melio offers a payment report feature that allows you to export a CSV file of any date range. This is helpful when it comes to physical record keeping, and also assists when calculating cash flow and budget. The file contains details of processed payments performed over a specific period of time that you manually set. This feature enables you to share your payments with anyone—both on and off Melio.

Melio is a safe and secure way to keep track of your payments. With this report feature, you can be sure that your payments are accurate and up-to-date. Melio offers a free trial so that you can try the payment report feature before committing to it. Sign up today to take advantage of this offer!

Melio Payments Pricing:

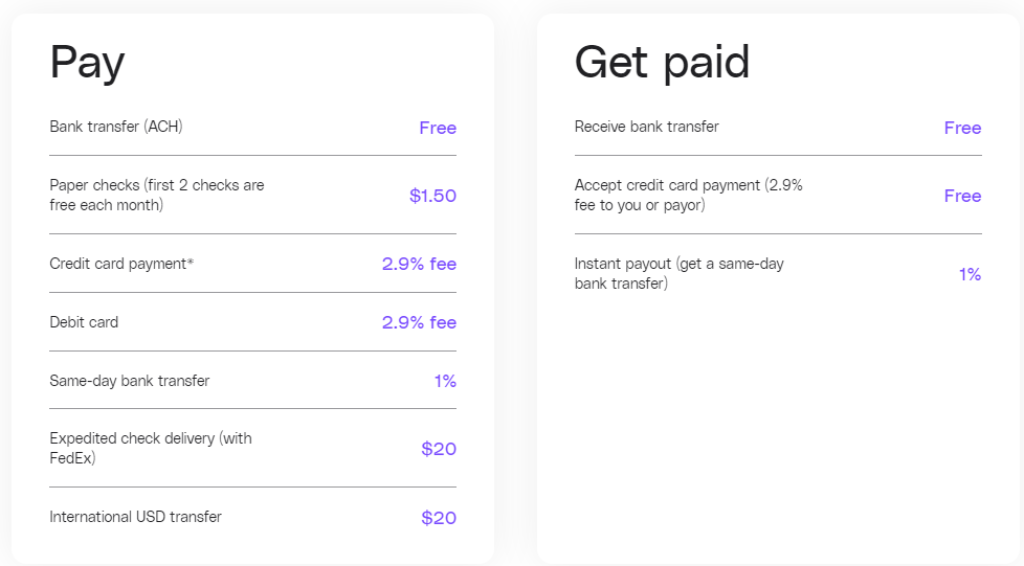

Melio is a great way to manage your finances without any monthly subscription fees. Melio offers free ACH bank transfers so you can easily and quickly send and receive payments. It is also great for businesses who want to make or receive payments differently. There’s a small fee attached for businesses who want to use Melio, but it’s still much cheaper than other financial management options out there.

| For Paying | Transaction Fees |

| Bank transfer (ACH) | Free |

| Paper checks (first 2 checks are free each month) | $1.50 |

| Credit card payment* | 2.9% fee |

| Debit card | 2.9% fee |

| Same-day bank transfer | 1% |

| Expedited check delivery (with FedEx) | $20 |

| International USD transfer | $20 |

| Get Paid | Transaction Fees |

| Receive bank transfer | Free |

| Accept credit card payment (2.9% fee to you or payor) | Free |

| Instant payout (get a same-day bank transfer) | 1% |

Which Industries Should Use Melio?

You’re in luck if your industry is included in the list below and you have a charge that has to be paid. Any industry, though, is usually understood to require payment as long as there are sellers.

- Construction Personal Services

- Food & Beverage

- Home Services

- Logistics

- Professional Services

- Retail Healthcare

- Wine & Spirits

Why Use Melio?

QuickBooks Online and AP sync without a hitch:

With automatic QBO two-way sync for all of your bills and bill payments, eliminate double data entering. Your accountant can immediately log in, analyze your account information, and download any necessary files from the Melio dashboard thanks to the built-in Quickbooks connectivity option.

Leading accounting software and AR are in harmony:

By integrating your accounts receivable with various software programs, like Microsoft Dynamics 365 Business Central, FreshBooks, QuickBooks Online, and QuickBooks Desktop, you may improve your payment workflow.

Profit from free ACH payments and receivables between businesses:

There are no enrollment or ongoing monthly fees for you or your customers. You can pay with a credit card for a tax-deductible 2.9% cost or a bank transfer is free.

Specialized tool for managing a team:

The team dashboard improves control and visibility for your company. With just a few clicks, you can assign team members to different clients.

In most circumstances, using it is free:

You don’t incur any fees when a business uses debit cards or ACH bank transfers to pay its bills, as we already indicated. What is there to love about free? However, there is a 2.9% service charge when paying a seller with a credit card. This pays for the costs associated with the card processor and gives team Melio the income necessary to maintain its feature set while introducing new services for its customers.

Dependable client service:

Customers of Melio get a dedicated customer relationship manager to help with any issues that might arise. The support staff at Melio takes providing excellent customer service seriously because the company’s business model depends on repeat business and residual income from service fees. It wants every business owner to feel important and valued.

Check out their comprehensive FAQ section, which has a wealth of information on the platform and how the service functions. Additionally, you can reach customer service at any time via phone, chat, or email.

Digitize B2B Payments:

Send your payment seamlessly through the system with ACH, debit and credit card payments. Create a custom experience, integrate our API or use front end solutions that are designed for you!

With Melio, getting paid is considerably easier:

If you own a small business or are a freelancer, we’re sure there have been occasions when you’ve needed to get paid right away due to a cash flow issue. By enabling your customers to pay their invoices with debit cards, credit cards, and ACH bank transfers, Melio makes it simple to be paid.

Melio is the payment option for you if, for any reason, your business or vendor cannot accept credit cards and you want to make it simple for your customers to pay your bill.

Control your payment process:

- Easily manage everything with a single login. From a single dashboard, you can access all of your customer accounts, including payment status and QuickBooks synchronization.

- Get committed assistance. Whatever you need, their team of professionals is here to assist you. You can contact them and they will address your inquiries.

- Include teammates. To better manage workloads and data access, add staff members to certain customer accounts.

- Provide what the clients’ vendors request. Vendors will be given the option of receiving payment via check or bank deposit after entering their payment information.

- Plan your payments. Save time and control your clients’ financial flow more effectively. Set up safe and secure payments in advance to be sent out at the appropriate times.

- Make approval workflows. Share payment duties while maintaining control. Select the team members who require what kind of approval and from whom.

Downsides Of Melio Payments:

Newer businesses experience growing pains. There is no such thing as perfection, and Melio is not an exception. The platform has some drawbacks that users should be aware of. For starters, Melio currently is unable to assist by paying international bills through their platform if your company does business with a vendor outside of the United States. We predict that they will resolve this issue soon given their hyper-growth rate.

Currently, Melio only offers Quickbooks as an accounting connector. You and your accountant might find it difficult to complete the activities that Quickbooks automates by hand. You may be sure that team Melio will soon introduce support for more data software integrations if you’re a Melio customer who doesn’t utilize Quickbooks.

Bill payments to vendors occasionally arrived late, according to Melio Payments reviews on numerous review websites. Even tiny firms cannot afford to pay their payments on time.

Regardless of the problem, Melio’s customer service team promptly addresses comments made on social media and in online reviews. On one occasion, in addition to resolving the issue, Melio made a donation to the client’s preferred charity. When it comes to client service and retention, Melio seems to go above and beyond.

Is Melio Payments Safe To Use?

Melio uses cutting-edge encryption techniques in its databases and for sending data, according to their website. Their servers are kept in data centers that are PCI and SOC 1, 2, and 3 certified and are watched over continuously.

Melio complies with PCI standards and does not keep sensitive data on its servers. They work with a Level 1 PCI Compliant Service Provider (TabaPay), a card processor, which is required to undergo an annual independent security audit of its systems and processes. To ensure the greatest level of security, the Melio team performs daily human and automated system testing.

Your money is never at risk since Evolve Bank & Trust holds all funds in a safe account until they are delivered to a vendor. What else? Every team Melio employee goes through a rigorous assessment process that includes security training and background checks.

Final Verdict:

Melio Payments is a fantastic payment option for any new business’s billing and invoicing needs. Payment processing is a very organized, uncomplicated, yet effective instrument for paying bills and invoices. It is far more efficient than its competitors.

We selected this solution because it is seamlessly integrated with our accounting program. It also gets rid of the hassle of printing and mailing paper checks. The chosen payment method can be seamlessly changed when the recipient does.

We would prefer to see just improved phone customer service reviews at this time. Vendors are added with their Melio links, and those who already have a QuickBooks account should join instantly. The vendor that is created when you do so is separate from the one that already exists in QuickBooks.

The ability to send international wire transfers in different currencies would also be an excellent addition. It would be amazing and provide a free connected workflow if it were fully integrated with Wave Invoicing.

But overall, considering that Melio Payments is free, I can honestly say that it’s worth a try at this point in time. It’s an excellent financial option for independent contractors, accountants, and small businesses. The latter category may automate their payments or invoices and manage every client from a single platform.

We rate Melio’s payment platform 4.7 out of 5 after analyzing the company’s website and independent reviews from around the internet, and we come to the conclusion that by assisting with the transfer of money to suppliers and from clients, Melio offers a special service to business owners. They offer a service that makes it easier for accountants to complete their work and helps businesses with cash flow problems.

Despite being a newer company, they are rapidly expanding and will soon become a mainstay in the small business world. After reading this evaluation, if you still think Melio Payments can benefit your company, go there right away and sign up for an account.

FAQ’s on Melio Payments Review:

How long does it take to receive Melio payments?

If payment is done via bank account it takes 3 business days. If payment is done via debit or credit card, it takes 1 business day.

How do I contact Melio payments?

You can read the documentation here https://melio.zendesk.com/hc/en-us. If you still have any issue, you can raise a ticket here https://melio.zendesk.com/hc/en-us/requests/new

How much does Melio cost?

Melio is free to use when you pay ACH to ACH.